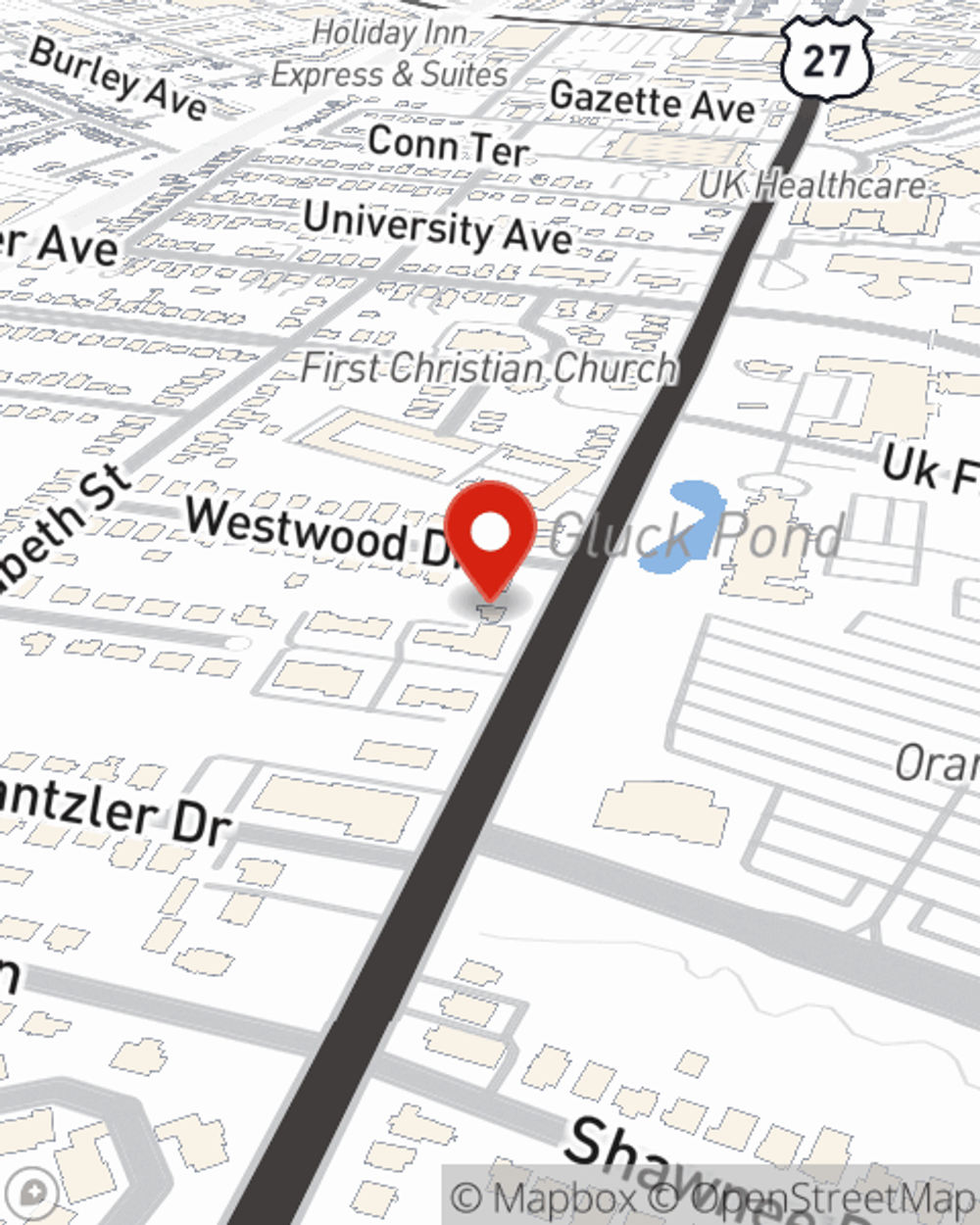

Life Insurance in and around Lexington

Protection for those you care about

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Fayette County

- Richmond

- Georgetown

- Versailles

- Nicholasville

- Winchester

- Central Kentucky

- Paris

- Lawrenceburg

- Harrodsburg

- Lancaster

- Danville

- Berea

- 40503

- Kroger Field

- Nicholasville Road

- University of KY

- 40502

- 40508

- UK campus

- 40507

- 40515

Your Life Insurance Search Is Over

Can you guess the price of a typical funeral? Most people aren't aware that the typical cost of a funeral in the U.S. is $8,500. That’s a heavy burden to carry when they are facing grief and pain. If the people you love cannot pay for your funeral, they may fall into debt in the wake of your passing. With a life insurance policy from State Farm, your family can thrive, even without your income. Whether it keeps paying for your home, pays for college or maintains a current standard of living, the life insurance you choose can be there when it’s needed most by your loved ones.

Protection for those you care about

Life happens. Don't wait.

Wondering If You're Too Young For Life Insurance?

You’ll get that and more with State Farm life insurance. State Farm has fantastic coverage options to keep those you love safe with a policy that’s modified to match your specific needs. Thankfully you won’t have to figure that out by yourself. With true commitment and terrific customer service, State Farm Agent Debra Hensley walks you through every step to build a policy that guards your loved ones and everything you’ve planned for them.

Simply visit State Farm agent Debra Hensley's office today to check out how a company that processes nearly forty thousand claims each day can help protect your loved ones.

Have More Questions About Life Insurance?

Call Debra at (859) 276-3244 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Debra Hensley

State Farm® Insurance AgentSimple Insights®

Building a special needs estate plan

Building a special needs estate plan

Setting up a special needs plan for a child or adult is critical. Consider a special needs lawyer to ensure protection and thoroughness of your plan.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.